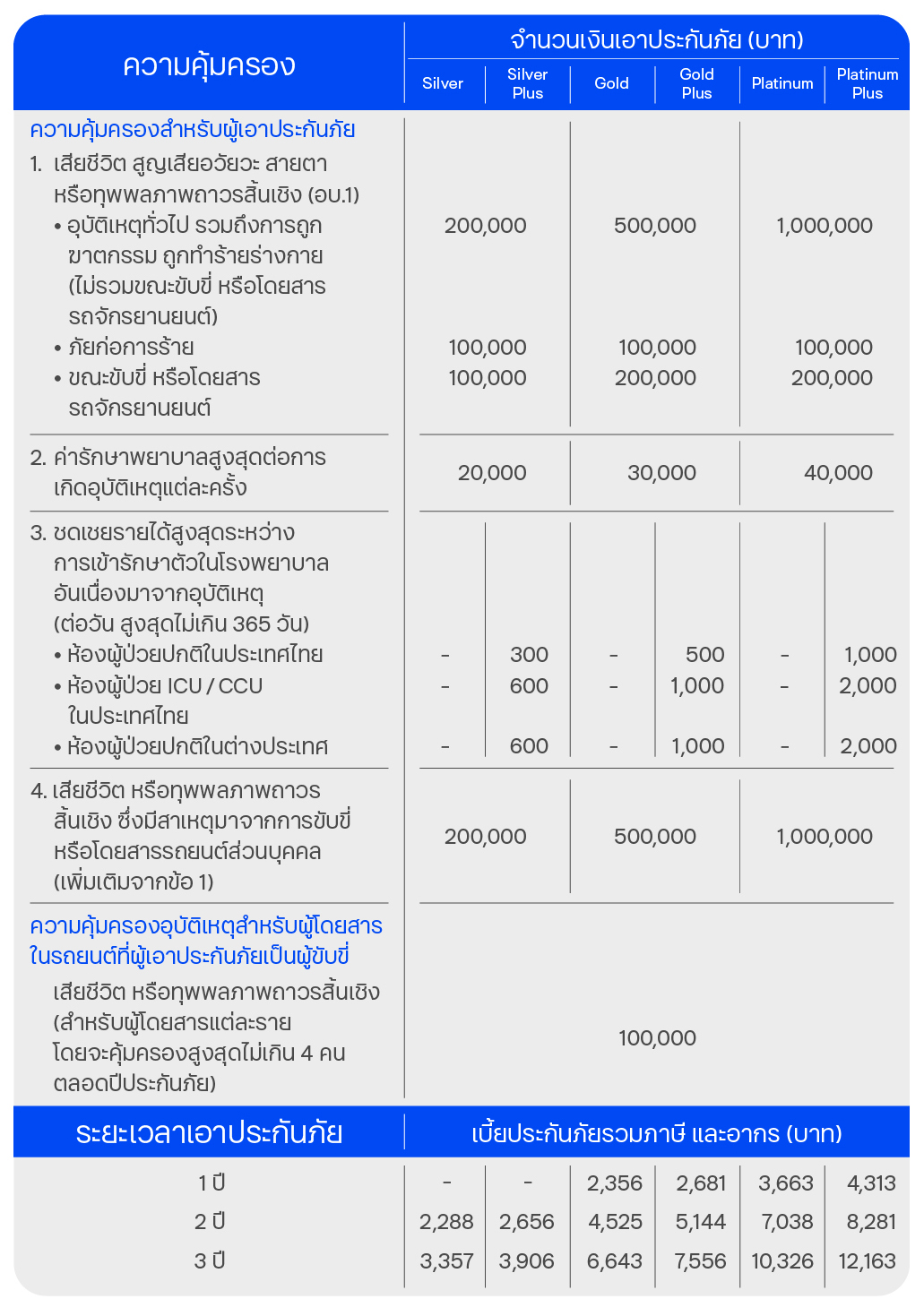

เงื่อนไขผลิตภัณฑ์

เอกสารประกัน

คุณสมบัติผู้เอาประกันภัย

- ผู้เอาประกันภัยต้องมีอายุตั้งแต่ 18 - 60 ปี ในวันที่ซื้อ (ต่ออายุได้ถึง 64 ปี) หรือทําประกันภัยครั้งแรก ในขณะที่ขอเอาประกันภัย

- ผู้เอาประกันภัยจะต้องมีสุขภาพสมบูรณ์ แข็งแรง และไม่มีสวนหนึ่งสวนใดของร่างกายพิการ

- ชําระเบี้ยครั้งเดียว

- แผนประกันภัยนี้ไม่ครอบคลุมกลุ่มอาชีพที่มีความเสี่ยงสูงดังต่อไปนี้ คนงานก่อสร้าง, มอเตอร์ไซค์รับจ้าง, พนักงานรับ - ส่งเอกสาร, พนักงานขับรถโดยสาร, ช่างไฟฟ้า, ช่างโรงเลื่อย, ช่างตัด - เชื่อมเหล็ก, พนักงานดับเพลิง, ลูกเรือประมง, กู้ภัย, ยาม, เหมืองแร่, ขุดเจาะน้ํามัน หรือก๊าซธรรมชาติ, นักกีฬาผาดโผน, นักกีฬาอาชีพ, หัวคะแนน, นักการเมือง หรืออาชีพที่มีความเสี่ยงในระดับเดียวกัน

ข้อยกเว้นความคุ้มครอง

- ไม่คุ้มครองการฆ่าตัวตาย พยายามฆ่าตัวตาย หรือการทําร้ายตนเอง การแท้งลูก การทะเลาะวิวาท

- การกระทําขณะอยู่ภายใต้ฤทธิ์สุรา สารเสพติด การก่ออาชญากรรม ขณะกําลังขึ้นหรือกําลังลง หรือโดยสารอยู่ในอากาศยานที่มิได้จดทะเบียนเพื่อบรรทุกผู้โดยสาร และมิได้ประกอบการโดยสายการบินพาณิชย์

- สงคราม การจลาจล การนัดหยุดงาน การก่อความวุ่นวาย การปฏิวัติ การก่อการร้าย และอื่น ๆ ตามข้อยกเว้น ในเงื่อนไขกรมธรรม์ประกันภัยอุบัติเหตุอุ่นใจ

- ผู้ซื้อควรทําความเข้าใจในรายละเอียดความคุ้มครองและเงื่อนไขก่อนตัดสินใจทําประกันภัยทุกครั้ง

- เงื่อนไขอื่น ๆ เป็นไปตามที่กรมธรรม์กําหนด

รับประกันภัยโดย

บริษัท ธนชาตประกันภัย จํากัด (มหาชน)

ธนาคารทหารไทยธนชาต จํากัด (มหาชน) เป็นเพียงนายหน้าประกันภัยและรับผิดชอบในฐานะนายหน้าเท่านั้น

รายละเอียดสิทธิ์พื้นฐาน

รายละเอียดสิทธิ์พื้นฐาน ดาวน์โหลดโบรชัวร์ (PDF File)

ดาวน์โหลดโบรชัวร์ (PDF File)