Our People

The Bank has policies and Human Resources and Remuneration Committee with duties to review and propose strategic directions on areas related to human resource management namely employee recruitment, remuneration and benefits, regulatory requirements on employment and labor relations as well human rights. Human resource management is a crucial part for the Bank’s continuity and growth. Therefore, the Bank intends to position the Bank to be the workplace where our employees can “Make REAL Change”.

Labor Practices Commitment

TMBThanachart is committed to upholding fundamental labor rights and fostering fair, safe, and equitable working conditions across its operations and value chain. We believe that respecting labor rights is not only a legal obligation but a critical foundation for sustainable business and social well-being.

As part of our commitment, we ensure the Bank’s labor practices reflect both international labor standards and national regulations. We also expect our contractors, business partners, and corporate customers to uphold these same standards as part of a responsible and ethical business ecosystem.

- Living Wage: The Bank strives to provide compensation that meets or exceeds the legal minimum wage requirements and Thailand’s living wage. We aim to ensure that all employees receive a wage that supports a decent standard of living.

- Working Hours and Leave: We are committed to avoiding or reducing overtime and excessive working hours and to setting fair and transparent maximum working hours in compliance with Thai labor laws. The Bank also ensures that all workers receive paid annual leave to support their physical and mental well-being.

- Fair recruitment, Fair Remuneration and Equal Treatment: The Bank promotes non-discrimination and strives to provide equal opportunities, fair pay, and career advancement for all employees, regardless of gender, age, disability or diverse background. Equal pay for equal work for men and women is a core principle of our labor practices. The Bank monitors closely on gender pay gap improvement.

- Responsible Workforce Transition: In the case of structural changes or termination decisions, the Bank commits to providing appropriate notice periods and consulting employees in a timely and transparent manner to reduce adverse impacts.

- Local employment: We aim to recruit, retain, and develop talent from the communities in which we operate, ensuring that local employees have access to meaningful career opportunities. This approach supports regional economic growth, strengthens community ties, and enhances cultural understanding within our workforce.

To ensure that our commitments are translated into concrete action, ttb has implemented the following programs across our organization:

- Ensure adequate wages at or above cost of living estimates or local benchmarks to provide financial security for all employees.

- Monitor working hours, including overtime management, to prevent overwork and protect employee health.

- Ensure employees are paid for overtime work, in full compliance with Thailand’s legal requirements and internal policies.

- Regularly engage with workers’ representatives to foster two-way communication and continuous improvement in working conditions.

- Routinely monitor the gender pay gap to ensure fair and equal remuneration for men and women, and to promote workplace equality. The gender pay gap is published annually in the sustainability report.

- Expand social protection coverage beyond public programs, including comprehensive group health insurance to support employee well-being.

- Ensure employees take their paid annual leave entitlements through the implementation of a mandatory annual block leave system, encouraging rest and a healthy work-life balance.

- Provide training and reskilling opportunities to support employees in adapting to changes driven by industrial transformation or climate transition — for example, through programs on digital transformation, transition finance and climate risk management.

- Support youth employment by offering university students on-the-job training through structured internship programs that provide real-world experience and skill development.

Ultimately, our commitment is to create a workplace where fairness, dignity, and respect are fundamental rights for everyone.

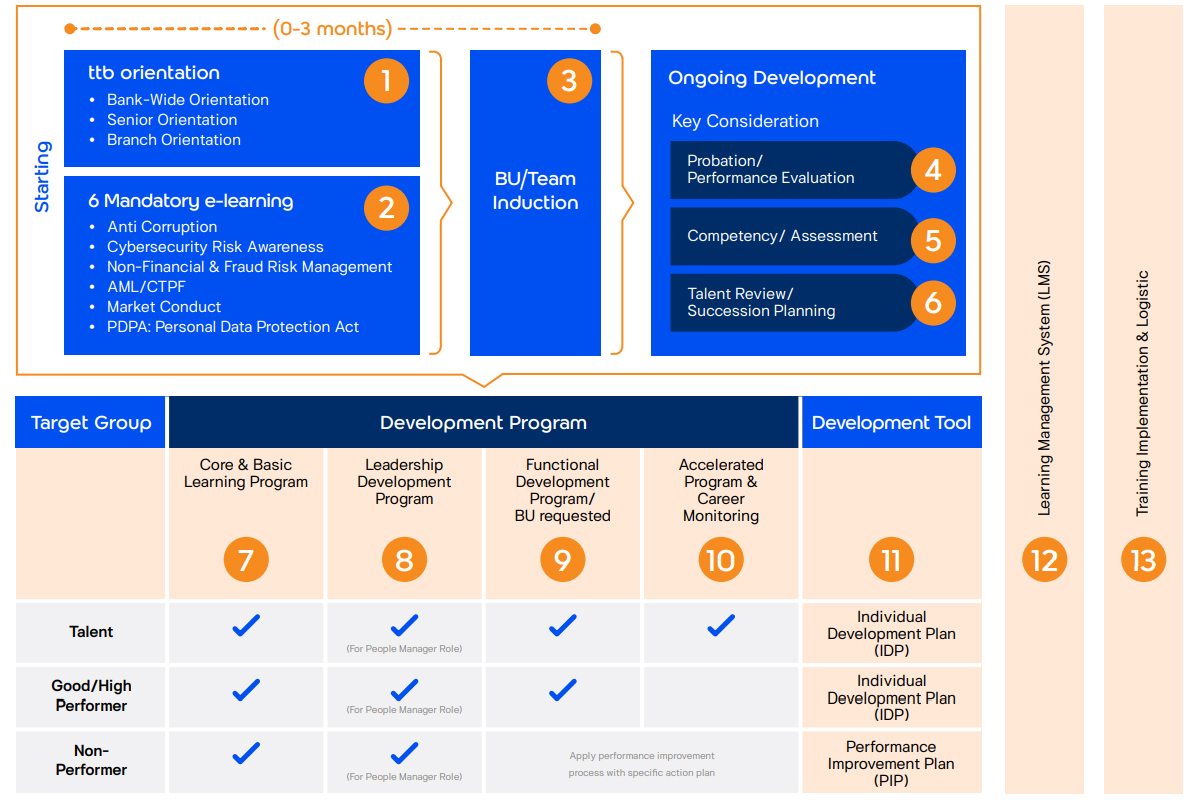

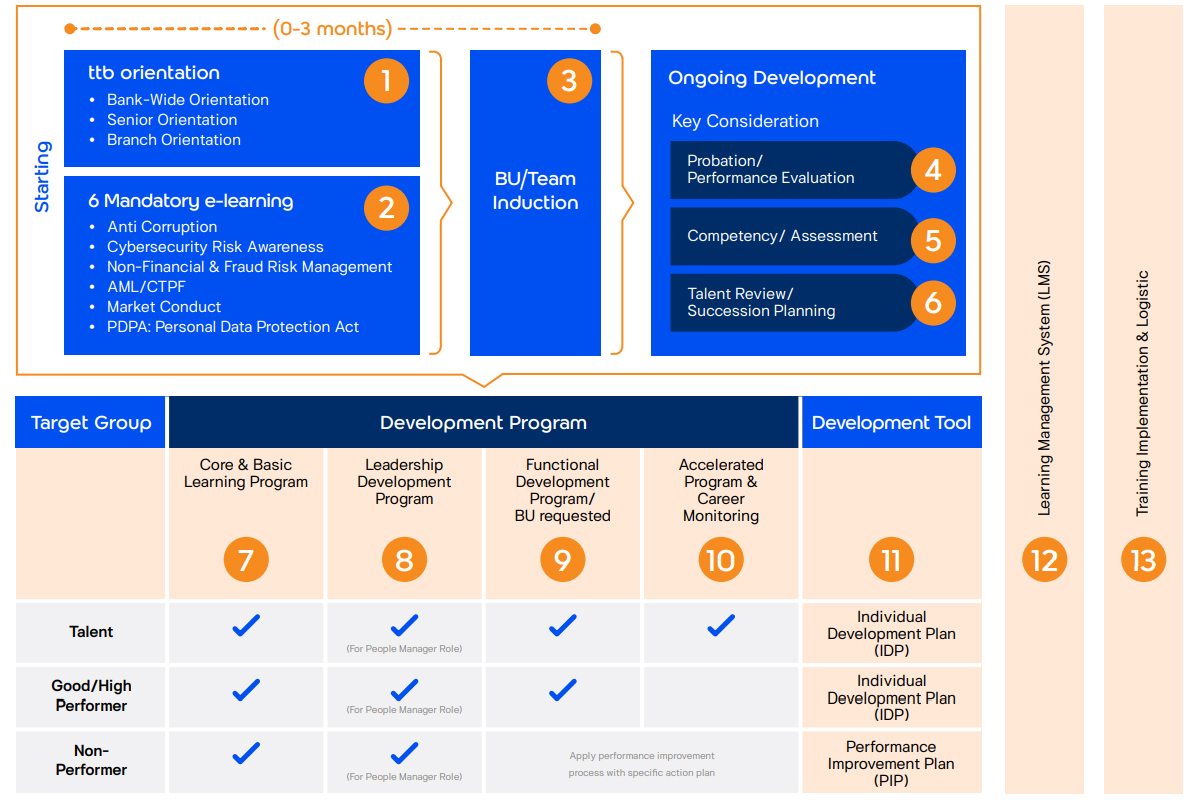

Human Capital Development

The Bank has a strategic training roadmap that is designed to strengthen leadership competency for all employees that empower them to fully perform in line with the Bank’s business goals. Training content is carefully tailored to fit each talent group and match with their needs for their jobs and future roles. The Bank measures Human Capital Return on Investment (HCROI) metric in the past four years (2021-2024). The results are 2.8, 3.2, 3.4, 3.6 respectively. In 2024, ttb employees completed a total of 566,631 hours of development training — averaging 39 hours or approximately 5 days per employee per year.

HR Roadmap and Strategy

At the Bank, we are committed to Make REAL Change in the Thai banking sector. By empowering our employees to always challenge and improve upon the status quo in everything we do, the Bank is in turn able to deliver value to all our stakeholders: our customers, our shareholders, our community and, of course, our employees themselves.

- Our employees have a clear career development plan – We offer a career mobility model based on individual potential. Employees use this for their career development planning and discuss it with their direct line manager.

- Our employees can move to a new career path and are provided with development opportunities within the Bank – We support employees to use their full potential to learn more about the business to advance the way we operate.

- Best Development – We are a learning organization with a structured development program.

- Performance Recognition – We offer a competitive performance-based pay scheme & recognition.

- Culture – We empower our employees to Make REAL Change.

Employee Learning and Development Program

The Bank designs learning and development initiatives to align with business needs and ensure effectiveness:

- Kirkpatrick Model defines expected business outcomes and behavioral changes before training programs are developed.

- Leadership involvement ensures senior management and people managers co-design programs with HR to enhance accountability.

- Blended learning approach integrates classroom training, virtual learning, and knowledge-sharing on a digital platform, enabling employees to learn anytime.

- Bite-sized learning model delivers microlearning modules for self-paced study, ensuring accessibility and engagement.

- Integrated development framework provides structured, goal-oriented learning, avoiding fragmented initiatives.

- Coaching and mentoring sessions are encouraged for all employees and employees engaged in the leadership development programs.

Learning and development programs are categorized into key groups based on:

- Competency-Based Development

Employees develop core skills essential for career success through structured training. The Core Competency Training Roadmap builds foundational skills, while Functional Competency Development within ttb Academy provides specialized learning in four areas: Sales & Relationship Management, IT & Data, Risk Management, and Product Development.

- Leadership Development

Leadership programs prepare employees for managerial and executive roles. New managers build people management and decision-making skills, mid-level managers refine leadership capabilities, and senior executives focus on strategic thinking and business acumen. High-potential employees receive fast-tracked career development opportunities to prepare them for leadership positions.

ttb Awards

ttb values employees’ values innovative efforts to effect real changes for customers and the Bank. As a testament to this commitment, the ttb awards event is hosted annually. This is an in-house competition that encourages employees to submit initiatives, products, or programs that promote customers’ financial well-being and/or improve the Bank’s performance in 6 areas: revenue generation; sales, service and operational excellence; data-driven risk management; digitalization; people and culture; and Make REAL Change which is the grand prize. The event also requires the participants to work across the business units as a team to expand their network in the Bank.

ttb Garuda Museum Visit

ttb proudly hosts the Garuda Museum at Bangpoo, offering visitors a unique opportunity to explore Thai culture through the rich history of Garudas. As part of our cultural engagement, ttb employees are encouraged to visit the museum once a year to deepen their understanding and appreciation of this national symbol.

Transition program for retiring and terminated employees

Recognizing the importance of a smooth and dignified transition for employees leaving the organization, ttb has developed a comprehensive transition program tailored for both retiring and terminated employees. This initiative reflects our commitment to lifelong learning, financial well-being, and continued contribution to society.

Key components of the program include:

- Debt Coaching & Financial Literacy Training: Retiring employees receive specialized training on managing personal finances, debt restructuring, and budgeting. These sessions are designed to empower them with practical tools to maintain financial stability post-employment and to share their knowledge with others in their communities as debt coaches.

- Skill Development Workshops: Participants are offered training in areas such as entrepreneurship, digital literacy, sales and communication enabling them to pursue new career paths or roles after leaving the Bank.

This holistic approach ensures that employees leave ttb not only with gratitude and respect but also with the confidence and capability to thrive in the next chapter of their lives.

Operational Risk Management and Security Awareness

With the concern on the impact to the customers and the Bank’s reputation, risk management and security awareness are one of the aspects that the Bank has seriously focused. We have then provided various risk and security related training programs i.e. Corporate Operational Risk Management, Anti Money-Laundering, Promoting Risk Awareness, Cyber Threats etc. to our people through the Bank E-Learning system which our employees in all over the country can easily get access to study at any their convenience time.

Employee Engagement

The Bank recognizes that employee engagement is a key factor in driving sustainable growth and development. To strengthen this, the Bank conducts an annual Voice of Employee (VOE) survey to assess employee engagement.

In 2024, the Bank conducted the VOE-Pulse Survey to gather employee feedback and use the insights to refine action plans that better address employee needs and concerns. The survey saw a 97% participation rate, with an average satisfaction score of 65%, exceeding the target of 64%. The survey results will be used to improve the organization’s strategies for fostering employee engagement and attracting and retaining talent. The Bank will also develop a plan to enhance employee engagement and employee satisfaction score.

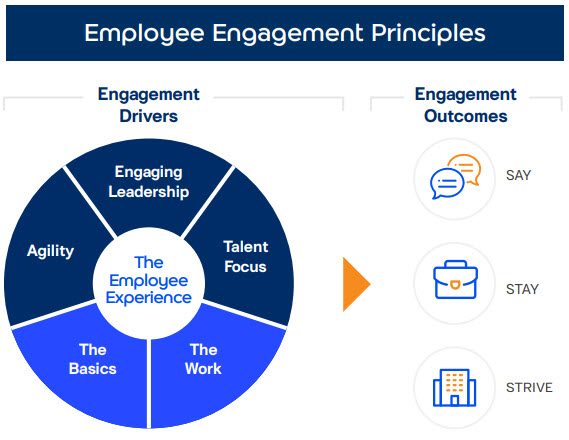

Employees who are engaged have 3 characteristics:

- Say positive things about the organization given the opportunity

- Stay with the organization

- Strive to go above and beyond for the success of the organization

Employees are engaged when they have a good employee experience. Here are the key drivers of employee engagement:

- Engaging Leadership

- Talent focus e.g., career development plan, number of employees, performance assessment

- Agility e.g., collaboration, diversity, customer-centricity

- The Basics e.g., physical health, mental health, stress at work

- The Work e.g., work satisfaction, happiness to work, work that fulfills their life goals

Recognizing the significance of high-potential employees, the Bank provides a long-term incentive for employees through the Employee Joint Investment Program (EJIP), fostering a sense of ownership within the organization. The EJIP program stipulates that the Bank will provide contributions to support employees’ purchase of the company’s shares for 3 years. The shares will be allocated to the participating employees’ account and employees will get dividends and have normal voting rights.

The Bank has a succession plan in place to fill top management positions that will be vacated due to upcoming retirements in future years. To ensure a smooth transition for successors and business continuity, the Bank has identified critical positions and successor profiles. The readiness of potential candidates that have been identified will be assessed against essential criteria, after which, candidates will be allowed to participate in the succession development program to enhance essential skills.

Employee Relations

The Bank recognizes that our employees are the drivers of our business; hence, we respect labor rights of our employees. At the Bank, Welfare Committee is established to ensure fair treatment and to protect the benefits of the employees, with a biannually meeting at a minimum. The employee representatives meet with HR function every 6 months to discuss issues regarding employees’ rights, benefits, and concerns. After the discussions, HR reports the key summary to the management committee for further decisions and actions. Moreover, the Bank has four employee unions: Thai Military Workers Union, Thai Military Employees Labor Union, Thai Military Bank Labor Union, and TMB Thanachart Labor Union, accounting for 20% of total employees.

The Bank and Employees have jointly established The Registered Provident Fund of TMBThanachart Bank Public Company Limited, which is managed by The Board of Directors of The Registered Provident Fund of TMB Bank Public Company Limited comprising employers, which come from the appointment and employees which come from the election from the member. The fund is managed under the Employee’s Choice scheme in which the employee can choose to save at the rate of 2-15% of their salary while the Bank contributes 5-10% to the fund. As of 31 December 2024, the Bank has 14,529 employees, with 13,867 or 95% of total employees participating in the Provident Fund.

Employee Performance Appraisal

The bank has implemented an internal process to assess employee performance, known as the employee evaluation appraisal. The primary objectives of this appraisal system are to promote teamwork, foster ttb culture and ensure compliance with the Code of Conduct, facilitate agile conversations, and enhance employee well-being. The process for evaluating employee performance consists of the following steps: 1) Define Criteria 2) Checkpoint (Mid-Year Review) 3) Finalize Criteria 4) Evaluation. Additionally, the bank employs both individual and team-based performance evaluations in this appraisal process. It emphasizes ongoing feedback through multidimensional performance appraisal approach, allowing for continuous communication between employees and their line managers.

Health, Safety, and Well-being

The Workplace Safety and Physical Security Policy provides approach to managing occupational health, workplace environmental safety, and physical security. Workplace Safety and Physical Security Policy is approved by Risk Oversight Committee (ROC) at the board level. The Occupational Safety, Health and Environment (OSHE) Committee is chaired by the CEO. The Committee consists of employer and employee representatives, with the Safety Officer serving as a secretary of the Committee. The OSHE Committee holds monthly meeting to consult and discuss safety issues identified by employees, develop necessary safety measures, monitor performance, and assess effectiveness of actions and plans implemented e.g., evaluating progress of reducing/preventing health issues/risks against targets. The OSHE Committee will ensure the adequate implementation of the requirements indicated in this policy as well as develop plans, taking into account this policy, on health and safety to prevent and reduce accidents, dangers, sickness, or annoyance resulting from Bank’s work and non-work related activities. Other parties involve in the management and execution at the operational level include Corporate Property and Services, Business Continuity Management, Department Heads in business units and support units (e.g., HR, etc.), managers of branches and other sales offices.

The Bank has a Zero Accident and zero Lost Day Injury Rate (LDIR) target, demonstrating its commitment to health and safety. The OSHE Committee ensures the adequate implementation of all OSHE requirements indicated in the policy and in the Ministerial Regulation on the Prescribing of Standard for Administration and Management of Occupational Safety, Health, and Environment 2006.

The Bank performs annual physical security assessment to ensure the adequate implementation and compliance with this policy including reporting and tracking status of non-compliance issues resolution in GRC. Health and safety risks are analyzed and identified to mitigate the impacts. Safety action plans and targets are in place to effectively manage health and safety issues; also, internal and external safety inspections are conducted regularly. The progress and update of health and safety matters are regularly communicated to the executive management, especially during the world pandemic, Covid-19.

All job activities are analyzed for any exposures to health and safety hazards where 3 job activities are currently at high risk including call center with exposure to noise and storage room and printing with exposure to hydrocarbon and volatile organic compounds. While appropriate control measures are put in place to control risks in these areas, should employees be found to have levels of these substances that are higher than the legal standards, the employee will receive appropriate treatment. The Bank will also investigate the causes of exposure and conduct regular testing on the affected employees until their health returns to normal.

Workplace Safety and Physical Security Policy

Workplace Safety and Physical Security Policy

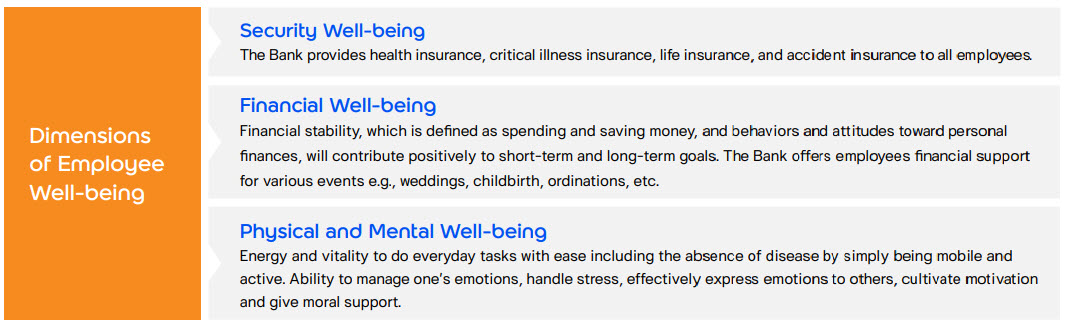

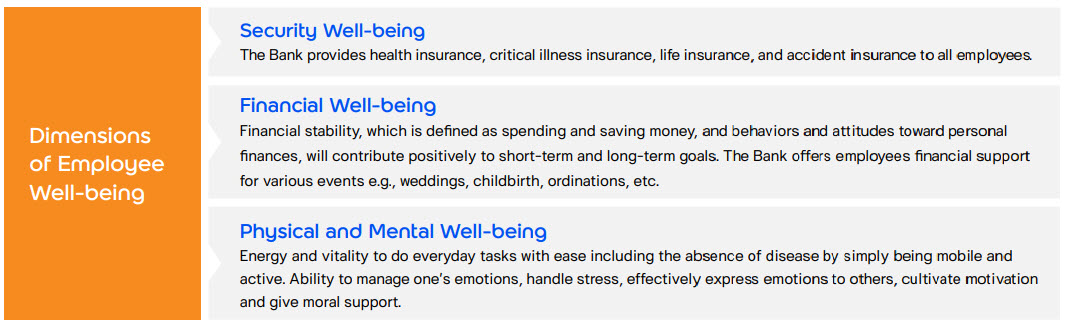

Employee Health and Well-being

The Bank takes care of our employees’ health and well-being in order to maintain a healthy and mindful workforce that helps advance the business. Safety measures are in place to ensure a safe environment for employees, customers and visitors. To build employee awareness, foster health and a culture of well-being, the Bank offers employees with benefits and conducts initiatives as follows:

Types of leave

- Personal Business Leave: 10 working days per year with full pay for employees to carry out personal business including taking care of family members with a physical or mental health condition (care leave), dealing with government agencies, bereavement leave, wedding leave, commencement ceremony, and any other occasions approved by the direct line manager

- Annual Leave: At least 10 days per year excluding public holidays (according to the length of service)

- Sick Leave: Paid sick leave for no more than 30 working days per year

- Ordination Leave: One-time ordination leave for no more than 120 days for the entire duration of the employment period

- Hajj Leave: One-time Hajj leave with full pay for no more than 45 days of the entire duration of the employment period

Support for employees with family commitments

- Paid parental leave for primary and non-primary caregiver: Full paid maternity leave of 14 weeks and full paid paternity leave of 5 days (1 week).

- A private lactation room with equipment and storage for mothers to use for pumping breast milk.

- Scholarship for employees’ children with a value of THB13,000 per academic year as one of childcare facilities.

Medical and well-being facilities

- In-house medical clinic at the Headquarter

- Fitness center

- Internal communication about health issues e.g. ergonomics, health, and nutrition, etc.

- Health check-up programs based on risk exposures such as audiogram test for call center staffs, spirometry and volatile organic compounds tests for staff who work in storage room and printing who are exposed to health hazards.

- Key indicators monitoring including indoor temperature, humidity, illumination, noise, particulate matter, chemical and bacteria in air, bacteria at the canteen, drinking water quality, hydrocarbon and volatile organic compounds in area at risk. The Bank regularly assesses these indicators for a healthy and safe work environment for employees’ well-being at least annually by external service providers. The assessment is according to the ministerial regulations and the notifications of the Department of Labor Protection and Welfare for work environments; heat, illumination and noise.

- Safety day and campaigns

- Flexibility of working hours and working-from-home arrangement

- Part time working option to support short-period tasks

Diversity in Workplace

The Bank commits to promoting diversity, equity, and inclusion. Above all, the Bank has zero tolerance for any behavior which is discriminatory on grounds of age, gender, sexual orientation (including LGBTQIA+), ethnicity, race, country of origin, nationality, cultural background, religion, belief, cultures, and socio-economic background. We believe that diversity is important for sustainable growth.

Since the launch of ttb’s Diversity and Inclusion Statement, which was approved by the Chief Executive Officer and the Board of Directors in 2019, the Bank has been publishing diversity and gender equality data and has continuously improved our corporate culture to support this commitment.

Key Initiatives and Progress

- Gender Equality:

One of the Bank’s key objectives is exemplified by the 2024 target to ensure that at least 40% of the workforce consists of women across all positions, including management roles, operational functions, revenue-generating positions, and STEM-related functions. Our compensation framework mandates that remuneration is to be determined by role and performance, irrespective of gender, ensuring equity at all levels. Furthermore, we regularly assess gender pay equity.

- Nationality Diversity:

We promote a multicultural workforce. In 2024, our employee composition by nationality is as follows:

| |

All levels |

Management level |

| Thai |

14,523 (99.95%) |

1,318 (99.70%) |

| Chinese |

1 (0.01%) |

1 (0.08%) |

| Hungarian |

1 (0.01%) |

1 (0.08%) |

| Others |

4 (0.03%) |

2 (0.14%) |

- Religion:

We respect all religious beliefs and provide facilities to support employees of diverse faiths. Discrimination based on religion is strictly prohibited.

- Gender Identity and Sexual Orientation:

We actively monitor gender representation, support employee well-being, and enforce a zero-tolerance policy on harassment. We also organize training programs to raise awareness and foster understanding of LGBTQIA+ inclusion.

- Age Diversity:

We encourage intergenerational collaboration and support reskilling and upskilling initiatives for older employees, especially those approaching retirement.

- Disability Inclusion:

We provide accessible facilities, welcome applications from individuals with disabilities, and offer financial support to Empowerment for Person with Disabilities Fund.

In addition to the rights at work, the Bank requires that all employees undergo an online Code of Conduct refresher training annually. The training covers content on equity and inclusion, emphasizing individual rights and prohibition of discrimination and harassment. This ensures that employees exhibit appropriate conduct towards both customers and others. In 2024, there is no labor standards non-compliance incident.

Diversity and Inclusion Statement

Diversity and Inclusion Statement

Workplace Safety and Physical Security Policy

Workplace Safety and Physical Security Policy