Corporate Governance

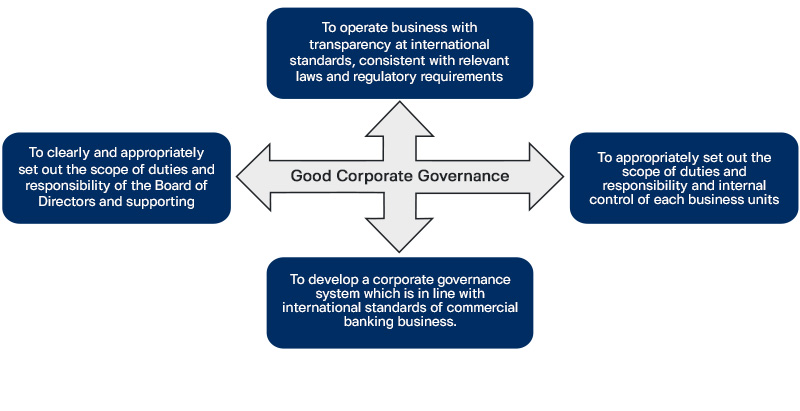

The Bank recognizes good corporate governance and business ethics have a great part in securing the overall sustainable business and bring maximum benefits to the stakeholders. We believe that they are building our bank’s foundation, have the alignment across all corporate governance principles, code of conduct and other policies and in line with international standards, laws and regulatory requirements. At the Bank, we give the priority to good governance by promoting it through the following practices:

- The Bank has always practiced good corporate governance as summarized below:

- The Nomination, Remuneration and Corporate Governance Committee has been set up to support the Board of Directors (BoD) in supervising the Bank’s operation and the performance of the BoD, supporting committees, executives and staff at all levels to comply with the good corporate governance principles.

- To supervise that compliance with the Bank of Thailand’s requirements is strictly carried out regarding the corporate governance for financial institutions. Also, the Bank has set up Corporate Governance Group to be directly responsible for good corporate governance.

- To raise the standards of good corporate governance to be at international standards, classified into 5 sections according to the guidelines and regulations of the Stock Exchange of Thailand, and covering the main issues as follows:

- 1) Rights of Shareholders

- 2) Equitable Treatment to Shareholders

- 3) Roles of Stakeholders

- 4) Information Disclosure and Transparency

- 5) The Board Responsibility

- The BoD has appointed the Company Secretary to be responsible for operations as regulated by the laws and support the BoD’s duties related to regulations, laws and best practice.

- The duty of the Bank’s Corporate Governance Group is to monitor that the business operations carried out by the Bank, which includes the directors, executives, and staff at all levels, are correct and in compliance with the guidelines set by laws and the regulatory requirements and are under the framework of the corporate governance for financial institutions. The Group is to propose changes in the Bank’s practices to be in line with such requirements such as the issue concerning independent directors.

- The Bank shall adhere to a policy of regular auditor rotation in compliance with SEC regulations, engaging in a tender process to appoint a new auditor every seven years. The Bank is prohibited from reappointing the same auditor for a period of five years following the conclusion of their term. This ensures auditor independence and objectivity in alignment with regulatory standards.

- The Bank gives priority to Corporate Social Responsibility (CSR) by following up relevant issues and attending meetings of various independent organizations in order to keep abreast of international practices and to have them further adopted.

- The review and revision of the code of conduct and business ethics are conducted to suit the executives and staff at each level.

Sustainability Governance

The Bank Board has determined the scope of Board oversight and appointed Board committees to be responsible on behalf of the Board of Directors. As sustainability has a growing significance to the Bank, the scope of Board oversight has been extended to include sustainability and its development program into the existing charter of the Board oversight scope as shown below:

The Board has appointed Nomination, Remuneration and Corporate Governance Committee (NRCC) to oversee and ensure effectiveness of sustainability management from the top. The committee must ensure effective and efficient corporate governance practice, review sustainability framework to serve long-term objectives, and ensure corporate culture to promote friendly environment, social responsibly and ethical business operations. The bank’s long-term objective is to be the most advocated bank with sustainable growth, therefore, Sustainability function is set up to execute sustainability initiatives and action plans together with relevant functions across the Bank and disclose sustainability related performance for transparency.

In parallel, the Risk Oversight Committee (ROC) has been delegated the responsibility of overseeing the management of climate-related risks, responsible lending practices, and the evaluation of environmental and social risks. The ROC ensures the Bank’s operations adhere to sustainable and ethically sound operational environment. Additionally, the ROC is responsible for reviewing and approving strategic directions and key policies, strengthening the Bank's commitment to sustainable finance. Climate-related risk indicators are reported quarterly to the ROC to manage and mitigate the impact of climate-related risks on the Bank’s long-term strategic direction and financial performance.

At the management level, the Bank has established executive committees to oversee sustainability matters. The Chief Executive Committee (CEC) is responsible for the overall sustainability strategy and management, while the Risk Policy Committee (RPC), delegated by the Risk Oversight Committee, is responsible for reviewing, endorsing, and approving the Bank’s policies, guidelines, standards, frameworks, criteria, models, risk appetite, and governance related to climate risk matters.

The bank’s long-term objective is to be the most advocated bank with sustainable growth, therefore, Sustainability function is set up to execute sustainability initiatives and action plans together with relevant functions across the Bank and disclose sustainability related performance for transparency.

The Bank complies with Thai laws including the Securities and Exchange Act B.E. 2535. In case the directors/executives omit to perform their duties with responsibility as specified in Section 89/7, the Bank may disgorge the benefits (clawback) from the directors/executives as per Section 89/18 and 89/19.