Customer Experience

The Bank continues to strive for excellence by asking itself how it can "Make REAL Change" in order to meet the needs of its customers, employees, shareholders, communities and society with products and financial services that are easy to use and understand, while initiating sustainable social activities for the betterment of society. The Bank is looking for ways in this digital age to create new experiences for all customer segments.

Customer Experience Management

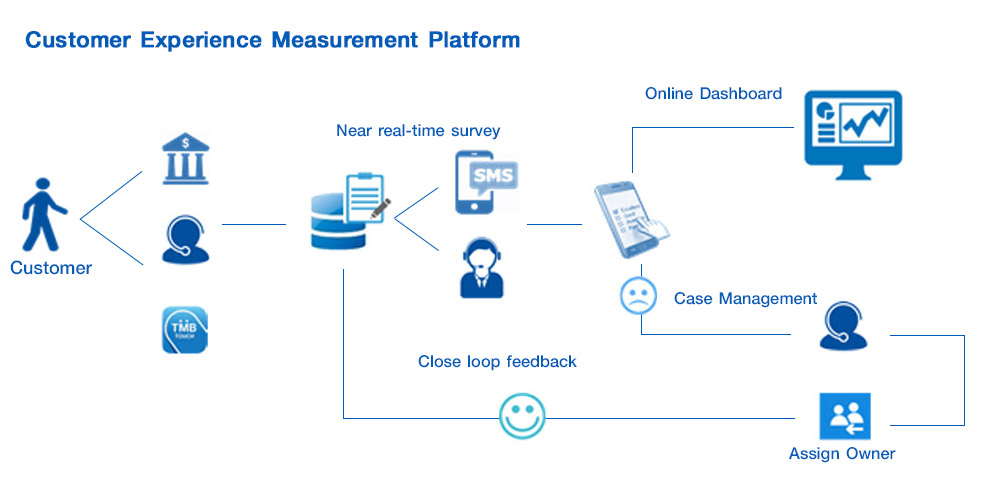

Customer experience management, a key proponent for building long-term relationship and brand loyalty, allows the Bank to fundamentally comprehend the baseline service levels, our method of interaction with customers, and performance in our service chain. the Bank measures customer experience performance in near-real-time across all 3 key touchpoints (branch, Contact Center and mobile banking) with the Bank using top-down Net Promoter Score (NPS) and Customer Experience Index (CX Index). Customer journey and targeted experience are designed in accordance with individual customer needs and interests in which clear and concise measures are established to ensure that the Bank fulfills their needs accordingly. This proactive measure was adopted by the Bank since 2017 as it enables the Bank to respond and remedy any transgressions in a timely manner.

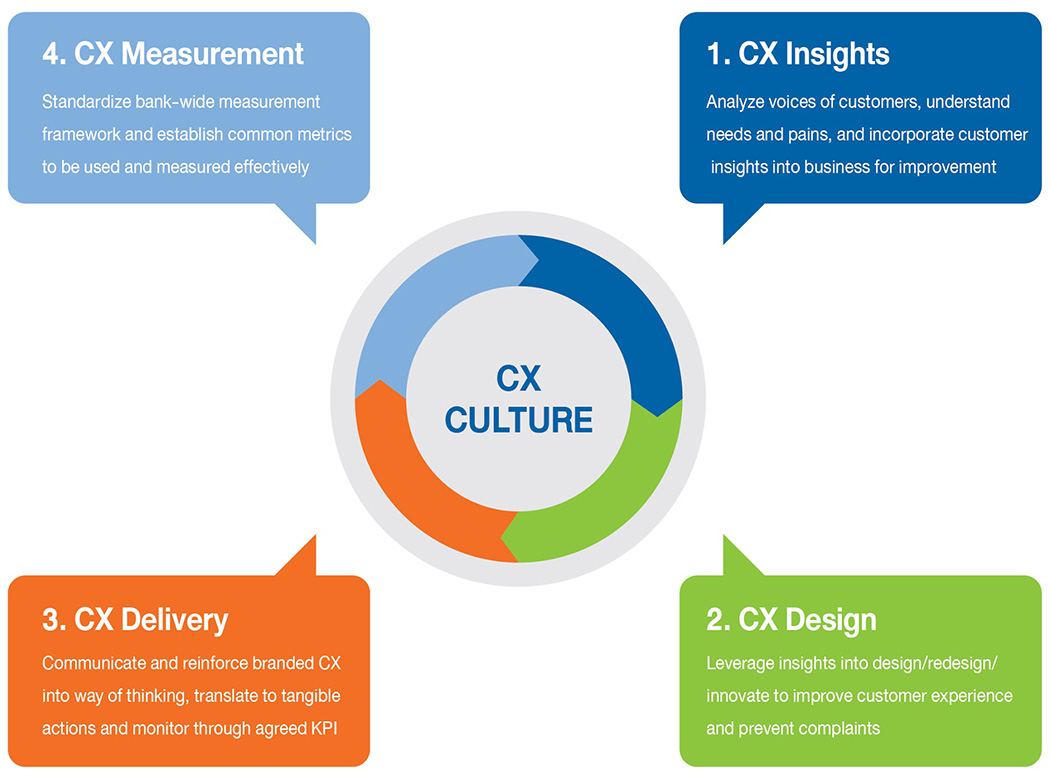

To be able to provide relevant Need-based, Simple and Easy experiences to our customers, the Bank begins the journey to set up strong foundation using Customer Experience Management framework which incorporates 5 key pillars: CX Insights, CX Design, CX Delivery, CX Measurement, and CX Culture aiming to build employee’s understanding and capability to deliver a sustainable Customer Experience Management program.

Customer Experience Journey Design and Measurement

Customer Experience is designed based on meaningful and differentiated Customer Value Proposition tailored for each customer segment and continuously improved through CX Analysis and Insights. Aiming to deliver a perfect journey for each individual customer along different product journey across each touch points, we constantly listen to the voices of our customers, take preventive and corrective actions in order to provide delightful experiences.

The Bank’s Customer Experience Measurement survey is done at transactional level across three key channels, branch, contact center, and digital channels. Customers will receive SMS with survey link or call almost immediately after their interaction with the Bank. Customer feedback is then captured and fed into online dashboard available for people manager to monitor performance, supervise frontline staffs and take corrective actions when needed. If customers provide negative feedback, CXM platform will automatically generate email alert to Customer Care Center to reach back to customer to investigate the case and correct customer experience.

With clear Customer Value Proposition developed from customer insights of specific customer segments, The Bank has been able to offer superior products and services that clearly create meaningful differentiation within banking industry.