- 1. Be able to correct and complete payment of goods to overseas trading partners (sellers) or designated recipients with the Bank’s outward remittance service.

- 2. Be ensured with the modern technology of international bank transfers via SWIFT network which is the international standard and is connecting the Bank’s allies across the world.

- 3. Support exchange rates in 20 foreign currencies (USD, EUR, GBP, JPY, AUD, SGD, HKD, CNY, CAD, NZD, CHF, DKK, NOK, SEK, KRW, AED, IDR, INR, MYR*, PHP*)

- 4. Select to debit from Thai Baht account or foreign currency deposit account (FCD) or multi-currency account (MCA) to transfer money to overseas.

- 5. Email notification service to notify transaction status with Debit Advice and Copy SWIFT service.

- 6. Track the status of your fund transfer from anywhere at anytime via OTT Tracking system.

*MYR and PHP FX rates are available upon request for telex transfers (T/T). Please contact Global Markets 02-676-8188

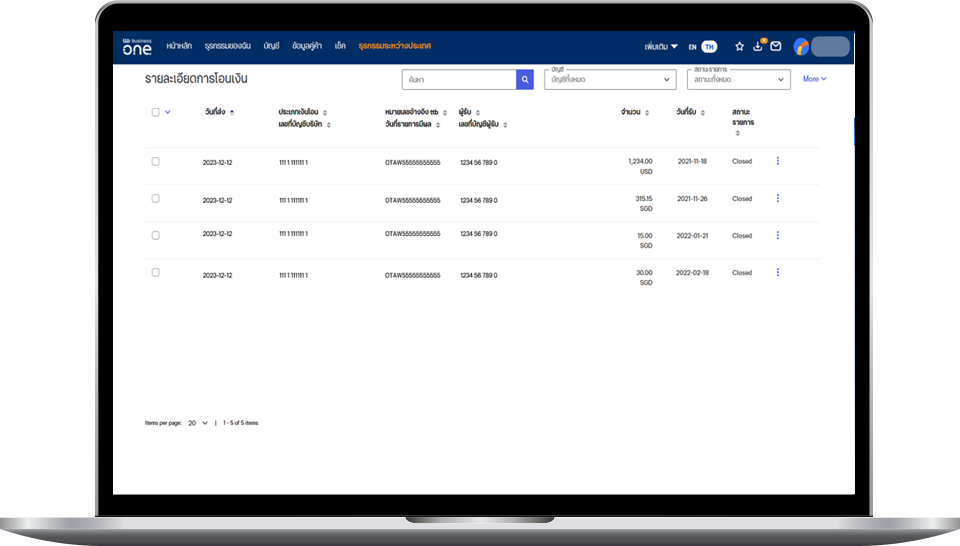

- 1. Outward Remittance via ttb business one

- 2. Outward Remittance via ttb business click

- 3. Outward Remittance at ttb international trade service center

Scroll for details

| Charged by | ttb outward remittance fee | Foreign Bank’s Charge Fee |

|---|---|---|

Sender is responsible for ttb fee and recipient is responsible for foreign bank’s charge (charge BEN) |

|

- |

Sender is responsible for both ttb fee and foreign bank’s charge (charge OUR) |

|

Additional Fees from Foreign Bank’s Charge are:

|

Special Offer! Transfer Chinese Yuan (CNY) to China via ttb business one with a discounted fee of 300 Baht per transaction — with no foreign bank charges (previously 750 Baht). Promotion period: 3 December 2025 – 31 December 2026.

Customers hold Thai Baht account or foreign currency deposit account with ttb.

- 1. Email notification for outward remittance when transaction completed with Debit Advice and SWIFT

- 2. Email notification for inward remittance when transaction completed with Credit Advice and SWIFT

How to apply

- 1. Download email notification application, fill-in and sign-off

- 2. Document required

- Company affidavit (issued within 3 months)

- Copies of the authorized director's identification card

- 3. Submit application and documents at any ttb branch

Application for email notification service for ttb international transfer

Application for email notification service for ttb international transfer