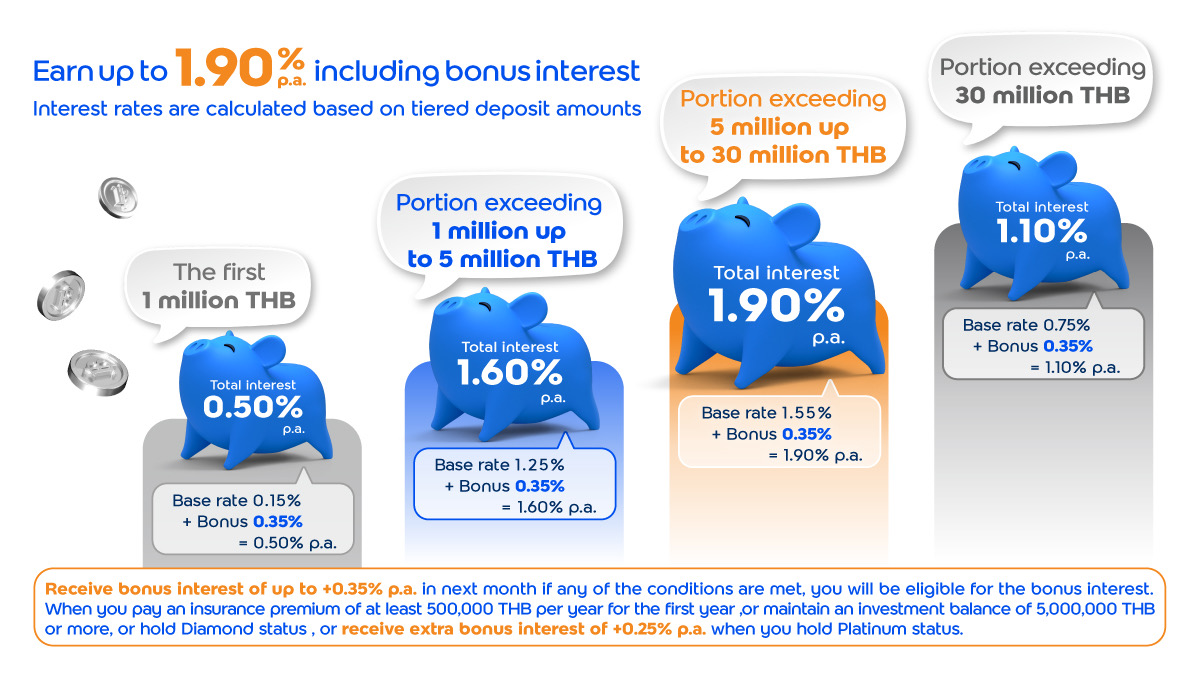

Receive normal interest rates based on deposit balance tiers for general customers:

- Deposit balance ≤ 1 million THB: 0.15% per year

- Portion exceeding 1 million up to 5 million THB: 1.25% per year

- Portion exceeding 5 million up to 30 million THB: 1.55% per year

- Portion exceeding 30 million THB: 0.75% per year

Receive bonus interest of +0.35% (ttb no fixed account) in the following month when meeting any of these conditions:

- Customer holds Diamond status in the current month, or

- Customer has an average investment value of ≥ 5 million THB in any mutual fund types via ttb in the current month

- Bonus interest is calculated based on the average fund value:

(NAV × number of units on allocation date) summed daily ÷ number of days in the month), or

- Customer pays the first-year premium of a participating life insurance policy

- 3.1 Minimum 500,000 THB per year per policy in the current month. Bonus interest applies for up to 12 months, or

- 3.2 If the customer pays a cumulative first-year premium of at least 500,000 THB per year, bonus interest applies until the next annual premium due date

- 3.3 The policy must be approved and past the free-look period

Eligible life insurance products: ttb infinity wealth 99/9, ttb happy life protect, ttb songtor kwam mang kang 99/5, ttb ultimate legacy 99/3, ttb happy retire 90, ttb infinity saver 88/8

Receive bonus interest of +0.25% (ttb no fixed account) in the following month when:

- Customer holds Platinum status in the current month

In cases where a customer qualifies for more than one bonus condition, only the highest applicable bonus interest rate shall be granted.

In cases that the conditions for receiving bonus interest are not fulfilled, Customers will receive the standard interest rate in accordance with the Bank’s official announcements

Interest rates, terms, and conditions are subject to change in accordance with the Bank’s official announcements.

product fact sheet of ttb no fixed account

product fact sheet of ttb no fixed account